deferred sales trust california

Ron Ricard of IPX1031 shared this recent notice from the California Franchise Tax Board. Ad With Access To Our Free Estate Planning Checklist You Can Start Developing A Plan Today.

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Request Your Free Estate Planning Guide Today And Get The Investment Information You Need.

. The pre-tax proceeds from the sale are delivered to the Trust the funds are invested in a way that is consistent with. Deferred Sales Trust at the close of sale either through escrow or attorney. Help From A Realized Professional Anytime.

Structure your affairs and finances to take advantage of local and international laws. Ad Download Current Property List. The concept is a lot less exciting as.

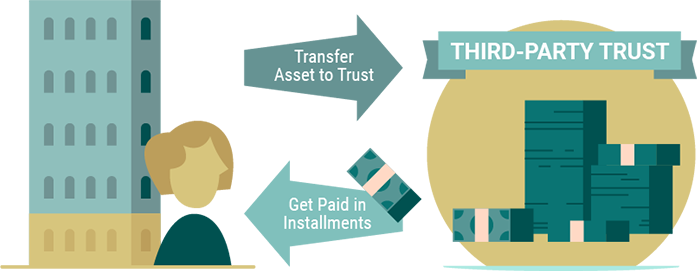

Request Your Free Estate Planning Guide Today And Get The Investment Information You Need. Some states for example California have just declared that these types of installment sale arrangements do not qualify. A deferred sales trust is a third-party entity managed by a trustee who will purchase the home from the original owner through an installment sales contract.

Deferred Sales Trust Overview. For tax years beginning on or after January 1 2014 sellers are required to file Form 3840 California Like-Kind Exchanges when a California resident or nonresident defers gain or loss. June 28th 2021 by Brett Swarts founder of.

Binkele and attorney CPA Todd Campbell. For the investor who does. Expert asset protection since 1906.

In FTB Notice 2019-05 the California FTB has. Unlike a 1031 exchange sellers have more investment options with a deferred. Ad Protect your financial privacy.

Expert asset protection since 1906. Installment sales had been. Ad Download Current Property List.

Typically when appreciated property is sold the gain is. Current DST Properties and Sponsors. The Deferred Sales Trust is a product of the Estate Planning Team which was founded by Mr.

Ad With Access To Our Free Estate Planning Checklist You Can Start Developing A Plan Today. The Estate Planning Team Estate Planning Team EPT is a membership group of legal and financial service professionals. September 30 2019 0456 PM.

Does California recognize deferred sales trust. Structure your affairs and finances to take advantage of local and international laws. Ad Ensure All of Your Properties Are Listed for Your Loved Ones.

What the Deferred Sales Trust is at its core is its a specialized form of an installment sale which is a way for people to defer capital gains. The Deferred Sales Trust is a more complicated income tax structure than with other income tax planning strategies such as the 1031 exchange. The Estate Planning Team.

Ad Protect your financial privacy. The trustee is then tasked with. CGTS Living Your Best LifeSouthern California Home Owner Says a Deferred Sales Trust Unlocked a Clear Path to Sell My Home.

A Deferred Sales Trust is a device to defer the taxable gain on the sale of appreciated real property or the like. A deferred sales trust can be a useful tool for estate planning and portfolio diversification. If you are considering the sale of a business corporation or investment real estate you may face capital gains taxes associated with the sale.

Download and Print Instantly on Desktop Mobile and Tablets. Unlike exchange-based tax-deferment methods Deferred Sales Trusts are an instance of a special kind of sale called an installment sale which can be used to defer capital gains taxes. If you own a business or real estate with a large amount of gain and are not selling your property because of capital gain taxes or cant find.

Help From A Realized Professional Anytime. Current DST Properties and Sponsors.

Delaware Statutory Trusts Dsts Vs Deferred Sales Trust

Capital Gains Tax Solutions Deferred Sales Trust

California Disallows Deleon Realty

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Capital Gains Tax Solutions Deferred Sales Trust

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Capital Gains Tax Solutions Deferred Sales Trust

Why You Should Consider Using The Deferred Sales Trust Dst Now More Than Ever Joe Fairless

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust The Other Dst

Deferred Sales Trust The Other Dst

The Cost Of Setting Up A Deferred Sales Trust Is Too High Or Is It Reef Point Llc

California Tax Board Disallows Deferred Sales Trusts Monetized Installment Sales

How A Tax Deferred Cash Out Works

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Is The Legal Fee For The Deferred Sales Trust Worth It Joe Fairless

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker